-

Updates: Bank Mergers & Acquisitions

Posted By Matthew Speed

Update: M&A in 2019

2018 was an interesting year for Mergers and Acquisitions in the Banking Industry. It was a fairly average year by number of transactions, 259 deals announced versus the five year average of 260. However, with pricing spiking and the economy staying strong, there were some large deals taking place. M&A activity, which changed significantly during the banking financial crisis, has traditionally been a large part of the banking industry and is important to look at for several reasons. Mergers and Acquisitions are a strong signal for how the industry is doing as a whole. When M&A activity is robust, the market sentiment for the industry is typically quite high.

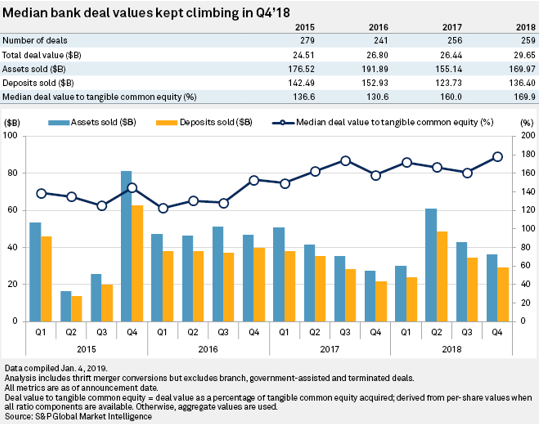

As highlighted in the chart below from S&L, bank prices have significantly spiked over the past two years:

M&A in the banking industry generally uses a deal value to tangible common equity value (TCE) to show the cost of the transaction. In 2015 and 2016, median deal value to TCE was 136.6 percent and 130.6 percent, respectively. However in 2017, this ratio jumped to 160.0 percent. By the end of 2018, prices had spiked even higher, up to nearly 180 percent in the fourth quarter!

M&A in the banking industry generally uses a deal value to tangible common equity value (TCE) to show the cost of the transaction. In 2015 and 2016, median deal value to TCE was 136.6 percent and 130.6 percent, respectively. However in 2017, this ratio jumped to 160.0 percent. By the end of 2018, prices had spiked even higher, up to nearly 180 percent in the fourth quarter!

There were also some larger deals announced in 2018, with Fifth Third’s acquisition of MB Financial being the largest in the past two years. This monumental acquisition was also one of the most expensive transactions, with a purchase price that was over 270 percent deal value to TCE. As deal pricing continues to earn premiums like this, it is not surprising that while the number of transactions were flat from 2017 to 2018, overall value of M&A increased over 10 percent, from $26.44 billion to $29.65 billion.

Another interesting development to M&A in the Banking Industry is that there were nine acquisitions of banks by credit unions during 2018. Dennis Holthaus, managing director at boutique investment bank Skyway Capital Markets, who has advised on several credit union-bank deals, said many credit unions now have excess capital and are eager to deploy it through growth strategies, including M&A.

"It (capital) can be deployed organically, but the cost of organic growth is going up on the deposit side without loan rates necessarily keeping pace, resulting in more credit unions looking to grow through mergers," said Holthaus.

Looking forward to what to expect for the rest of 2019, we already know that there are some big things happening on the M&A front. Assuming the mega deal between SunTrust and BB&T closes without any regulatory intervention, 2019 should be a huge year based on overall transaction value! That said, we are more than half way through the year, and only 120 deals have been announced. It appears that less, not more M&A activity will happen this year, based on number of transactions. This is due in part to the stock market turmoil that hit the market at the end of 2018. Many bankers are expecting offers against their 52 week high stock price from late 2018. With prices down significantly from that point, we have seen a gap in expectations between buyers and sellers.

Our current estimation is that M&A activity will be relatively stable to maybe even a touch soft in 2019, with approximately 220-240 deals completed. Considering the complexity and time required to complete a merger between banks, there would need to be a significant number of executed agreements in place relatively soon to have growth in M&A activity this year. One wild card to consider, will there be a continued uptick in credit unions acquiring banks?

This trend could put pressure on deal pricing and help spike additional transactions throughout the year. Regardless of what happens in the second half of the year, 2019 is shaping up to be even more interesting than last year!

Update: M&A in 2018 (& De Novos!)

During the first quarter of 2018 I discussed 2017 bank M&A activity, and briefly summarized what to expect for 2018. One of the issues I highlighted was concern over the cost of acquisitions in the financial industry. Now that it’s the third quarter, I have a clearer picture on this subject.

From the first quarter of 2016 to the first quarter of 2018, deal pricing spiked from around 120 percent to almost 175 percent of deal value-to-tangible common equity ratio. This surge in pricing can be attributed to several factors:

- The strong stock market moved overall stocks higher

- The financial performance of many institutions increased stock prices even further

- A burst of M&A was inevitable due to pent-up demand in the industry due to the shift in regulatory environment

Richard Bove, a well-known industry analyst, states that he thinks it will be a record year for bank M&A activity. I am not sure that will be the case if deal pricing continues to climb at a 21 percent annual clip.

Over the last two quarters, it appears deal pricing in the industry is beginning to stabilize. If the trend holds, it may continue to drop in the last six months of the 2018. Deal pricing dropped from the peak of 175 percent in the first quarter to about 158 percent in the current quarter. According to S&P Global, 177 banks announced mergers as of Aug. 15, 2018. This report is right on pace to equal last year’s M&A volume. I believe deal pricing will have a big impact on volume the rest of the year. If prices spike again, I doubt the industry will reach last year’s total of 260 mergers, let alone set any records. If prices continue to drop or at least remain stable, we could very well see a flurry of deals announced in fourth quarter.

An interesting side effect of the higher acquisition costs and friendlier regulatory environment is we are finally seeing de novo banks again. During 2013 – 2017, only five new banks opened in the entire U.S., compared to this year, eight banks are poised to open and more are being announced every month it seems. The focus of many of these potential institutions is niche markets or underserved demographics. This is good news, both for the financial sector and the economy as a whole.

I believe M&A will continue to drive new bank formation in the coming years. As the industry consolidates, opportunities are created for underserved markets. When institutions combine, there are usually very experienced executives that leave and are hungry for the next opportunity, this can often translate into forming a new institution.

Before the financial crisis it was common to have more than 100 new bank formations in a given year. Over the next few years it will be interesting to see if new bank formation can return to its past levels. It is possible there has truly been a fundamental shift in the market and new banks will be relegated to the one off exception.

If the regulatory environment and economy cooperate, I think we could start seeing many new banks over the next few years.

Make sure to subscribe to the blog for more M&A updates.

Review: M&A in 2017

It’s that time again to look back at 2017 to see what the merger and acquisition (M&A) activity was for the year and how that may affect our current year. It is important to look at M&A activity for several reasons. It is often used to predict how the industry is doing as a whole and give insight into how the industry will fair in the near future.

During the financial crisis of 2008 M&A activity slowed dramatically. However, it has steadily increased and has been relatively stable over the last several years. The US has experienced solid economic growth during this period and banks have benefited tremendously. In the last 5 years, the banking sector has averaged 260 merger deals per year, according to SNL’s deal tracker and 2017 was no exception. According to well-known analyst Dick Bove, the banking industry is on the cusp of a merger boom. He believes that banks have excess cash they need to invest, which combined with the dramatic shift in the regulatory environment, will spur rapid M&A activity.

Looking forward at 2018, there is a great deal of optimism for the banking sector as a whole. The potential for interest rates to continue to increase has already had a positive impact on bank earnings. The possibility of less regulatory burdens under the new administration has also had a big impact on bank valuations. This optimism in the industry has had a significant impact on one area related to M&A – it is getting more expensive.

Bank prices have significantly spiked over the past year. The 2015 and 2016 median deal value to tangible common equity (%) was 136.6% and 130.6% respectively. However, in 2017 this ratio jumped to 160.0%. Even more telling, during the first quarter of 2018, this ratio has further spiked to 174.2%! So while Mr. Bove is very bullish on bank M&A this year, this spike in the cost of acquisition could have a cooling effect on M&A activity. It will be interesting to see if prices can maintain this trajectory or if they will hit a ceiling sometime in 2018. If bank valuations continue to climb, we may finally begin to see De Novo banks again.

Based on the 54 deals that have been announced through the first quarter of 2018, it does seem that less, not more M&A activity will happen this year. Our current estimation is that M&A activity will be relatively stable and may be even a touch soft in 2018, with around 200 deals completed. Considering the complexity and time required to complete a merger between banks, there would need to be a significant number of executed agreements in place relatively soon to have growth in M&A activity this year. However, if prices do cool off, there could be a quick spike later this year that could still drive M&A activity to new heights.

Predictions: M&A in 2017

Looking back at 2016, the number of completed mergers dropped to 220 completed deals, down from 258 Bank mergers in 2015. This can likely be attributed to the uncertainties in the economy and political environment during the last six months of 2016. While the number of mergers decreased, the trend of banks with total assets less than $500 million were the majority of acquired banks continued.

Looking forward at 2017, there is a great deal of optimism for the banking sector as a whole. The potential for interest rates to finally increase will have a positive impact on bank earnings. Continued strong jobs growth, and the possibility of less regulatory burdens under the new administration has a big impact on bank valuations. All of the above signals the economy is poised for growth in 2017.

This optimism in the industry could impact merger activity in different ways. As valuations rise, more banks are going to find the idea of being acquired appealing. However, as profitability increases and regulation becomes less burdensome, smaller banks may find it no longer necessary to merge or be acquired. These two forces will be competing with each other over the next 12-18 months. Depending on which thinking prevails, M&A growth in the sector could strengthen or remain flat.

I estimate that M&A activity will be relatively stable in 2017, with around 200 deals completed. Considering the complexity and time required to complete a merger between banks, there would need to be a significant number of executed agreements in place relatively soon to have growth in M&A activity in 2017.

If the economy continues to improve and regulatory burdens do ease, it could be a banner year for bank profitability. This in turn could make 2018 the "year of the merger."

Predictions: M&A in 2016

Over the last few years M&A activity has steadily increased, and according to Mark Olson, a former FED Board Governor, is poised to have a banner year in 2016. There are several factors driving this increased activity including fewer FDIC assisted transactions due to earnings stability and heightened regulatory burden increasing the need for economies of scale. I've narrowed the increase in M&A down to two main reasons:

1. Changes in Economic Conditions

The economy has improved, and so has bank profitability. This translated into a healthier banking system, which naturally lead to fewer bank failures. During 2009 and 2010, the peak of the financial crisis, there were actually more FDIC assisted acquisitions (302), than M&A transactions (292) within the two year period. Thankfully, the ratio of FDIC assisted transaction to M&A activity reversed course in 2011 and has remained on a positive trend ever since.

In addition to the better overall economy, helping to spur M&A activity is the first Fed funds rate increase in nearly 10 years. Rising interest rates have a positive impact on a bank’s overall net interest margins and creates an environment for increased earning power.. Since the banking sector is stronger than it has been in many years, there are perceived opportunities for healthy institutions to grow, and M&A is always the fastest way to do so.

2. Changes in Regulatory Factors

Just as important as economic factors, regulatory factors and expenses were a very serious concern for financial institutions of all sizes. The need for economies of scale to handle the dramatic increase in regulatory expenses is one of the reasons we continue to see smaller institutions looking to be acquired, or sell to a larger organization. Including, but not limited to, the factors of regulation and the economy, creates an environment ripe for further industry consolidation.

While it seems the industry is ready for more consolidations, it may not happen as fast as many industry experts are predicting. The banking industry is notoriously slow moving. Merging two institutions into one organization is a significant undertaking rife with risk, something the industry is naturally averse to.

In my opinion, with 115 agreements in place as of the end of 2015, there will be an increase in M&A activity in 2016. The nature of banking seems to be returning to more M&A activity, one more sign that the banking industry is back to business as usual.

Matthew Speed

SVP / Market View Solutions

Hometown: Pensacola, Florida

Alma Mater: University of West Florida

The Author, Matt Speed, has nearly 25 years of experience in the banking industry. The first part of his career was spent at community and regional banks. He has worked in leadership roles in most of the various banking lines of business. Matt has spent the last 12 years at Ceto, leading a team of consultants managing engagements to improve profitability at community FIs.