VendorLink™

Power Smarter Vendor Strategy. Reduce Risk. Cut Costs.

Ceto’s contract intelligence solution helps you optimize vendor relationships, improve negotiation outcomes, and gain clarity across more than 450 contract cost areas.

Optimize Contract Spending through Smart Vendor Management

Save $50K-$100K Annually

per $100M in Assets

How it Works

| A CRITICAL ELEMENT FOR VENDOR MANAGEMENT

Linking Contract Intelligence & Vendor Performance Strategies

The VendorLink™ solution is a vendor contract intelligence and cost reduction solution that focuses on contract negotiation strategy, enhanced scope of services, and risk mitigation, with an analysis of more than 450 vendor contract cost areas while providing insights to optimize vendor performance.

| VALUE PROPOSITIONS

- Risk-Free with ROI Guarantees

- Data-Driven Actionable Intelligence

- Cost Optimization & Risk Mitigation

- Time & Resource Efficient

- Tailor-Made Engagements

- Industry Experts & Insights

- Trusted Partner

| OBJECTIVES

Contract Intelligence

- Realize Actionable Vendor Contract Intelligence

- Leverage Proprietary Vendor Data Warehouse

- Improve Visibility of Vendor Relationships & Contracts

- Achieve Industry Best Practices & Expert Insights

- Enhance Contract Negotiation Positioning

Vendor Performance

- Reduce Vendor Contract Costs/Risks

- Streamline Vendor Selection/RFP Roadmap

- Strengthen Vendor Relationships & Service Standards

- Enhance Vendor Roadmap & Scope of Products

- Optimize Technology Alignment/System Integrations

| VENDOR & CONTRACT ASSESSMENT

Contract Intelligence

CONTRACT ANALYSIS & VISIBILITY

Our team of strategic analysts will evaluate the vendor contracts at your financial institution and benchmark milestones to reach your goals. When the time is right to negotiate with each vendor, we will alert you and provide a thorough plan of strategic methodology to negotiate with each vendor.

INDUSTRY DATA & BEST PRACTICES

Our team of analysts evaluate and monitor industry trends to keep our pricing strategies and product knowledge sharp and up to date. Additionally, we leverage our internal database of more than 1,000 contracts to benchmark your current costs and terms against others in your peer group.

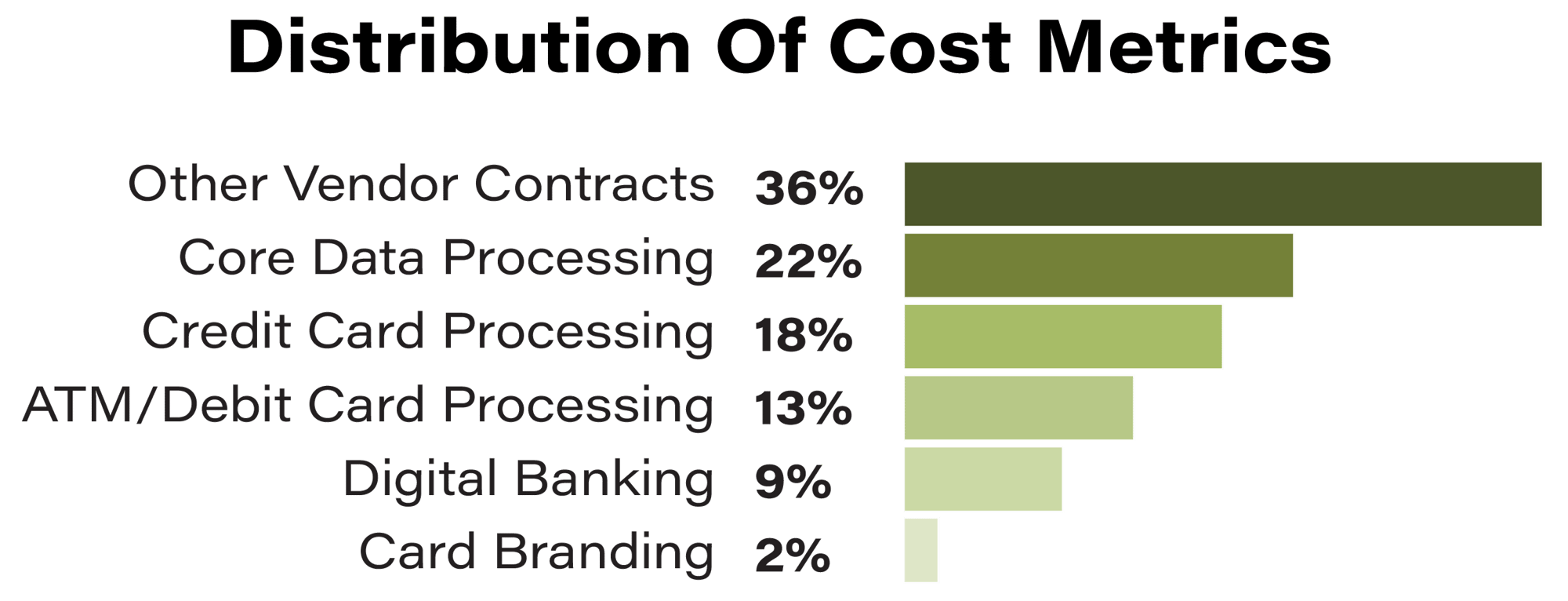

BENCHMARKING & COSTING METRICS

We develop customized benchmarks and cost metrics for each client. This allows us to compare your current costs against industry standards and our target cost benchmarking data.

VENDOR PEER GROUP ANALYSIS & COMPARISON

We compare your costs against those of your peers to identify areas of improvement and leverage opportunities to aid in our negotiations.

TRUSTED PARTNER & INDUSTRY EXPERT INSIGHTS

Our strategic analysts have invested over 15 years in building vendor relationships and negotiating contracts. We frequently attend vendor conferences and seminars and are thought leaders in contract negotiation strategy and market technology and trends.

Vendor Performance

CONTRACT NEGOTIATION & RISK MITIGATION

We begin by conducting a detailed appraisal of your contracts, comparing your costs against target cost benchmarking data. From there, we develop customized negotiation strategies for each vendor engagement, including risk assessment.

VENDOR SELECTION & ROADMAP

While staying with your incumbent vendor is the first choice, if your financial institution feels it is time to assess the vendors in the market, we work with you to select 3-5 that best meet your goals and make plans to progress down to a final vendor of your choosing. We will look at how all of your vendors integrate and the timeline of change.

RELATIONSHIP MANAGEMENT

The relationship you have established with your vendor is important to us, and we will maintain the current relationship while strengthening the dynamics and ensuring you have several paths to customer service, training, and product development.

SCOPE OF SERVICES

Through a rich analysis of your current scope of services, we’ll identify opportunities to eliminate unused services and add more functional and efficient services to move you closer to your financial institution’s goals. We’ll ensure payment strategies, marketing, growth metrics, and analytics are in place.

DIGITAL CONSULTING

Our team will meet you where you are with your current online banking, mobile, and bill pay contracts. We’ll collaborate on a roadmap that brings the digital experience to the forefront of your customers or members that aligns with the branch experience. We’ll ensure your third-party vendor integrates and identify technology gaps.

| DATA-DRIVEN ANALYSIS & INSIGHTS

450 Contract Areas

| CORE DATA PROCESSING

100+ contract cost components or areas:

- Cost per Open Account

- Cost per Closed Account

- Fee per ACH

- Software Maintenance

- Module & API Fees

- Fee per ATM/Debit Card Record

- All Other Related Charges & Fees

| DIGITAL BANKING

40+ contract cost components or areas:

Digital Banking- Monthly per Users Fees Consumer & Business

- Fees for Internal Transfers & P2P Transfers

- Fees for Cash Management Services

- Cost for Online Account Opening

- Cost for Online Loan Origination

- Fees for Site Hosting & VPN

Online Banking

- Monthly Base Maintenance

- Cost per Enrolled Device

- Alerts & Notifications

- Remote Deposit Capture

- Monthly User Fees

- Monthly Bill Fees

| ATM/DEBIT CARD PROCESSING

60+ contract cost components or areas:

- PIN/POS Debit Card Transactions

- Signature Debit Card Transactions

- Card Account File Management

- ATM Residency Fees

- ATM Terminal Driving & Support

- All Other Related Charges & Fees

| CREDIT CARD PROCESSING

80+ contract cost components or areas

- Card Account File Management

- Card Authorization Transactions

- Statement Preparation and Management

- Fraud Monitoring & Reporting

- Rewards Revenue and Expense

- All Other Related Charges and Fees

| CARD BRANDING

10+ contract cost components or areas

- Principal or Affiliate Agreements

- Visa, MasterCard, Discover Debit

- Conversion & Launch Support

- Marketing Funds

- Volume-based Incentives

- All Other Related Incentives and Fees

| OTHER VENDOR CONTRACTS

160+ contract cost components or areas

- Item/Image Processing

- Check Printing

- Communication Services

- ATM/Equipment Maintenance

- Armored Car Services

- Debit Payments Network

- Credit Reporting

- Other Contract Types Upon Request

| 3-PHASE APPROACH TO VENDOR EXCELLENCE

Minimal Disruption. Maximum ROI.

We value your time and understand that your team is juggling other strategic initiatives that are equally instrumental to the growth and profitability of your organization.

As such, we are committed to minimizing the disruption to your team's daily schedule, as we do not require any onsite visits for the engagement.

We conduct 95% of the effort on the project, while working independently within a flexible framework and schedule that fits within the needs of your team members.

Phase I: Appraisal [2 Weeks]

- Collect Contracts for Review

- Perform Analysis & Quantify Cost Savings

- Complete & Deliver Appraisal

Phase II: Roadmap [2 Weeks]

- Review Appraisal and Discuss Options

- Create Vendor Strategy Roadmap

- Establish Milestones and Resources

Phase III: Negotiation [TBD]

- Receive Authorization to Begin Negotiations

- Submit Proposals to Vendors

- Complete the Negotiation Process

- Execute Renewal Contract(s)

How the VendorLink™ Solution Impacts Your Efficiency Ratio

By integrating contract intelligence with vendor management discipline, we aim to reduce costs, mitigate risks, and enhance vendor performance. Whether you’re renewing contracts or assessing new partners, Ceto's data-driven approach helps you achieve sustainable cost savings and improved efficiency ratios.