-

4 Tools for Attracting and Retaining Deposits in a Digitally Competitive Landscape

Posted By Matt McCall

With four rate hikes from the Federal Open Market Committee (FOMC) throughout 2018, paired with a growing economy and rising loan demand, the battle for deposits remains highly competitive. Rising rates have allowed online-only banks to gain a significant market share by offering savings accounts at “X times the nationwide average!” Digital-only banks now draw approximately 12 percent of all new primary banking relationships in the U.S., versus 4 percent a decade ago according to TNS Research. In addition, large banks are expanding their branch footprint, such as Chase is opening up to 90 new branches by year end – most likely paired with a deposit growth strategy they’ve employed before, such as offering significant bonuses for newly funded deposit accounts.

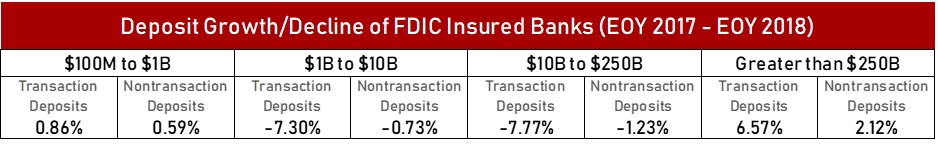

Using the “FDIC – Statistics on Depository Institutions Report,” you can observe deposit growth/decline by asset size from EOY 2017 – EOY 2018 as follows:

With the data mentioned above in mind, how can Community Banks, Regional Banks, and even Credit Unions better compete for deposits?

The data shows banks with assets from $1B to $250B aren’t retaining deposits effectively, and those with less than $1B could use a catalyst. With digital technology and big data shaking up the financial industry, sometimes the best defense is a good offense. In this digital era, there are four areas of focus in which financial institutions can better attract and retain deposits.

1. Competitive Options

Considering the availability and extent of social media and digital marketing, customers have a better awareness of other offerings compared to 10 years ago. Competitive options are a key factor in retaining and attracting new customers. As competition intensifies for deposits, community banks and credit unions must focus on and revitalize their retail offerings – on both the consumer and commercial level.

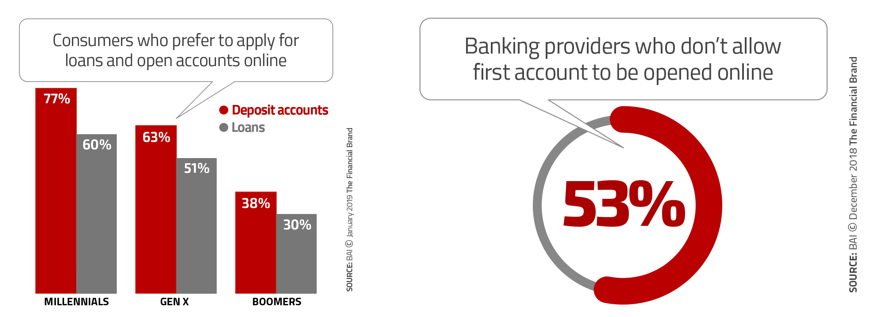

We’ve seen Uber release a rewards Credit Card from Visa, and Apple is well on its way to offering Apple Card, both with perks and no annual fee. These easy access Credit Cards offer novelty and also a seamless application process for the consumer via mobile. Financial institutions have no choice but to remove the friction in opening and maintaining banking relationships. Better market research, product development and pricing, digital landscape and experience, etc. do not require new departments or employees. Often times, a clear strategy and the right partnership can be more beneficial/cost-effective versus an in-house approach.

2. Transparency through data

According to American Banker, this year alone Chase spent $1.4B on technology. I believe investing in technology is the best way an institution can gain access to a collection data that provides transparency into the needs of an institution. Backend technology advancements can harvest valuable data for the financial institution, and allow a seamless user experience. Online and mobile banking is no longer a “feature,” but has come to be expected, and can be a liability in customer retention if not sufficient. Without an app and online platform, accounts and information can seem inaccessible to customers. Tech innovations provide efficiency, ease-of-use, and transparency throughout financial institutions as follows:

- Better data means more transparency for management, in-turn being able to make actionable decisions based on trends and concrete numbers.

- Receiving better, real-time data supports employees in decision making by evaluating the entire banking relationship, with the opportunity to cross-sell when applicable.

- Anything that makes life easier for the consumer, such as online account opening, transparency through mobile and online banking, etc. encourages deposit growth/retention.

3. Relationships

When referring to the FDIC Insured Banks’ deposit growth/decline above, the smallest asset tier ($100M to $1B) outgrew banks from $1B to $250B in transaction/nontransaction deposits. Small community banks do not have the funds to contribute $1.4B toward technology like Chase, but they do have an advantage when it comes to customer relationships. Small community banks staff typically know their customers on a personal level, making it significantly easier to retain business and make trusted recommendations.

Although it may be difficult to know customers on a personal level at financial institutions with significant assets, there are still ways to achieve great customer relationships. Many sales efforts across community banks and credit unions are not fully developed. Personalized contact can go a long way, especially in the banking world. For example, birthdays are a great opportunity to reach out and lay the groundwork for future discussions – which can lead to a conversation regarding the overall banking relationship and how it could improve.

One way your financial institution can continue to nurture relationships through technology is by investing in a digital referral service. This is a fruitful, low-cost gateway to gaining more deposits. According to Ernst and Young, 71 percent of global consumers consult friends, families and colleagues first about banking products and relationships.

Relationship accounts/pricing can also be valuable if structured and marketed correctly. The value is reflected through increased cross-selling, higher customer retention, larger deposit balances, decreased risk, and the potential to be the consumer’s primary financial institution. That said, incorrect relationship products/pricing can negatively affect profitability. Ensuring pricing is in line with competition/surrounding markets but also unique to individual strategy is important, but can be cumbersome. Community banks and credit unions could be best served by outsourcing these services to an unbiased ancillary party.

4. Personalization

Historically, financial institutions have built a few products around segments of the population in a tiered fashion, retroactively slicing customers into their segment of the pie. This “few sizes fit most” approach leaves behind potential customers and leaves current customers underserved. According to Sonia Wedrychowicz, head of Consumer & Community Banking Technology at Chase, “Personalization driven by an effective usage of analytics is therefore, in my opinion, the biggest gap that the banks need to continue to bridge quickly in order to be able to effectively compete.”

For a lesson in personalization, let’s look to tech behemoths Amazon and Netflix. Despite serving millions, both companies have a personalized touch leaving the end-user feeling it was specifically designed for them. Data analytics allows both companies to personalize, predict, and suggest the next product/service. By capitalizing on data analytics, financial institutions can achieve similar adaptive digital interfaces, tailored opportunities, and a personalized consumer journey. McKinsey estimates personalization can deliver five to eight times the return on investment in marketing expenditures, and can lift sales by 10 percent or more.

Conclusion

These four areas of focus are not meant to be segmented, but rather encourage a unified approach in growing deposits. Competitive options will become increasingly important as the world continues to flatten. Transparency of data equips the institution for future endeavors, while transparency of information makes the consumer comfortable. Relationships are a linchpin to the success of financial institutions, and can foster valuable referrals. Personalization takes relationships one step further – making the consumer feel important, as they are the most important part of the business.

Matt McCall

Consultant

Hometown: Valdosta, Georgia

Alma Mater: Georgia Southern University

I enjoy the outdoors alongside my dog Huxley, playing sports, and spending time with friends and family. Music junkie at heart. Coaching, woodworking, and swing-trading are some other interest I enjoy pursuing.