-

Do We Really Need Staff in Branches?

Posted By John Mateker

As technology continues to advance in Artificial Intelligence (AI), Robotic Process Automation (RPA), machine learning, chat bots, and robotics, there’s a question that needs to be asked: are employees required to staff branches at all? There are already financial institutions experimenting with people-less branches by deploying a variety of automation. In this blog, I am going to discuss how branches are beginning to use AI and RPA to reduce staff in their branches and how it will potentially impact the future of branches.

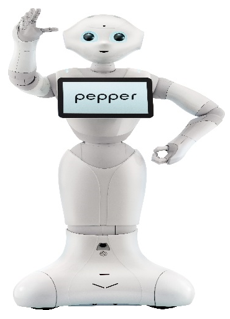

People commonly think that AI often means robots, however not all automation is related to robotic processes, but they do play a role. For instance, some organizations use robots created and manufactured by SoftBank, a Japanese telecom and internet Corporation, and its subsidiary Aldebaran Robotics.

SoftBank and its subsidiary created two different robots; Nao and Pepper. Each have similar capabilities to interact with customers and provide product and other information. Pepper even has the capabilities to play games and entertain customers while they wait for further assistance with more difficult requests and services. As of right now, financial institutions deploying Pepper primarily use the robot as a greeter for their institution. Pepper is able to provide basic account information, answer customer questions and is equipped with a tablet computer that customers can enter information into directly. Most institutions experimenting with these robots are simply replacing human greeters with an automated greeter, but are still operating the branch with teller and platform staff.

However, in early 2017, Bank of America opened three pilot branches without any personnel whatsoever. These branches use ATMs for personal transactions and platform activities. Also, these branches have private rooms available to speak with a banker via video conferencing. Bank of America refers to these branches as automated centers and occupy about 25 percent less square footage than the typical branch. The smaller footprint reduces occupancy expenses, while still providing customers with the opportunity to interface with a live person if needed. The Bank of America pilot shows that the concept of a people-less branch is possible.

There are certainly up front investments to make this happen. However, Ceto believes there could be significant staff changes depending upon technologies deployed within the branch. Our own studies suggest that branches often have 4 to 8 FTE staffing the branch dependent upon transactional volumes, lobby business, day of the week, time of the month, etc. Labor arbitrage of at least 60% of this staff could be made considering there might still be central staff supporting these branches. Staff savings would be an ongoing cost savings to an organization. Depending on location and employment rates, some clients have problems finding qualified staff to work in their branches. Certainly a solution like this might help with those issues as well.

Another example of banks and credit unions incorporating technology to lower their branch staffing is the deployment if Interactive Teller Machines (ITMs) in lieu of tellers within the branch or drive thrus. ITMs allow for customers to interact with a virtual teller or use the machines like an ATM depending on the individual’s needs and time of day. With video conferencing capabilities available, a financial institution could deploy ITMs and interactive video conferencing to perform most transactions at a branch and with robots like SoftBank’s Pepper in the mix. A customer could be greeted by a robot, provided information directly by the robot, and taken to an ITM or video conferencing room for additional assistance with a live person.

With advances in AI, intelligent chat bots and robotics, the future of branches and even some back office support functions will not have any human intervention. As robots continue to develop dexterity and a programmed personality, some financial institutions may take advantage of the new technology by staffing an entire branch with robots.

What would this look like? What would the robots look like? With population shifts in some parts of the world, you could even see hybrid branches comprised of humans and robots. If you think about the capabilities of Pepper or Nao, and how some financial institutions are deploying them, this is already occurring. Will our customers be open to speaking about new accounts or loans with a robot? Only time will tell. As for me, growing up as a science fiction geek, I look forward to the day when we can interact with an intelligent and conversational robot. Let me know your thoughts in the comments below!