-

Challenges Facing Banks and Credit Unions During the Coronavirus Pandemic

Posted By Stephanie Jordan

During these trying and unprecedented times, banks and credit unions are going out of their way to take care of their customers and members. As a consulting group, we are closely monitoring the challenges facing financial institutions today and into the future. The Coronavirus pandemic has created an incredible strain on profits and capital. Three areas stand out in terms of putting the most strain on profits and capital during the Coronavirus pandemic:

- Huge Demand for New Loans

- End-to-End Loan Originations and Inefficiencies

- Transactional Consequences and Staffing Impacts

The Paycheck Protection Program (PPP) program has created a tidal wave of new loan requests. In addition to this program, bank and credit union clients are requesting extensions and modifications to existing loans. This places an additional burden on your loan review, credit analysts and other lending staff.

If your financial institution has questionable or potentially problematic processes prior to the increases in loan origination volume, we are finding that these large volumes exacerbate these pain points and result in processing errors and repetitive work. And with branch transactions potentially moving to other channels such as mobile, remote deposit capture, and ATMs, it is important to ask what your community banks and credit unions are doing to meet potential long-term transactional shifts.

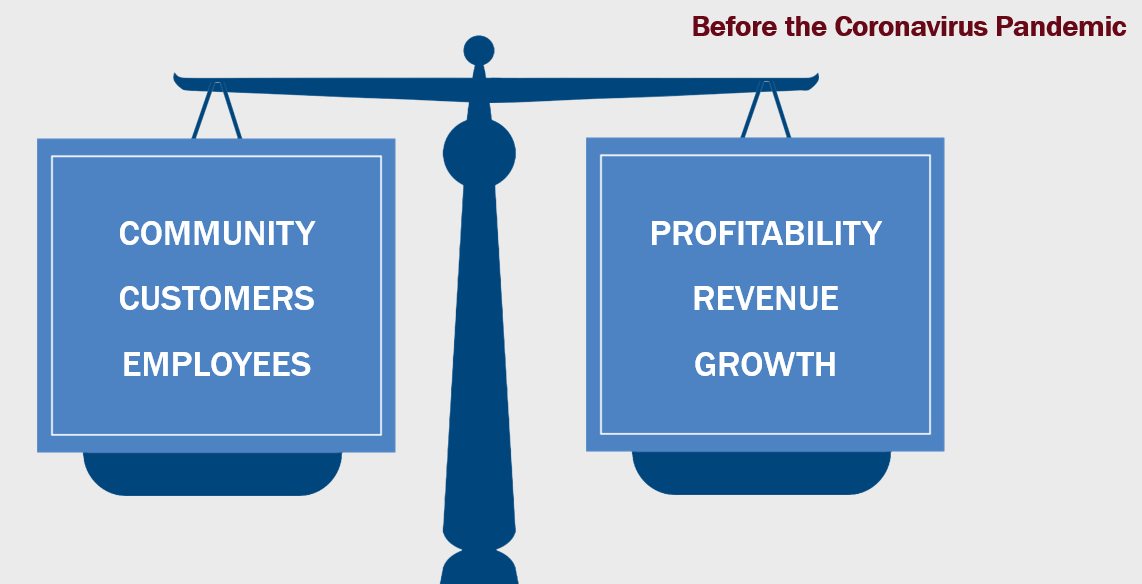

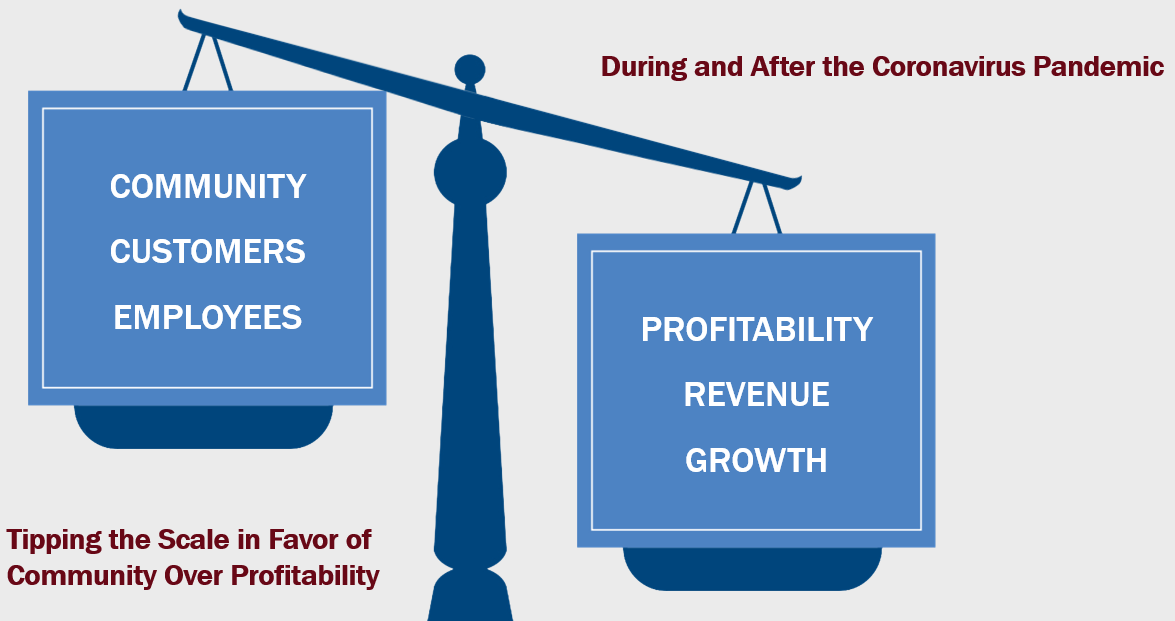

The chart below here discusses this great dilemma: community versus profitability. Prior to the current outbreak, community banks and credit unions have been successful in carefully balancing the needs of the community with their own needs to generate profits, maintain a healthy capital structure, and grow within their markets while still serving their community, customers and employees.

However, the Great Dilemma has now shifted and profitability, revenue and growth have taken a backseat to serving the community, customers and employees.

If you would like to learn more about how to balance long-term profitability and capital while still helping your customers and members during this unprecedented time, please check out our latest on-demand webinar, “How to Deal with the Coronavirus Pandemic: A Huge Dilemma for Financial Institutions.” This webinar discusses the following topics:

- Similarities and differences from the 2008 banking crisis, and what we’ve learned from it

- The areas that financial institutions will be squeezed, and proactive measures that need to be taken now

- What we might expect from regulators down the road based on what we learned from the 2008 banking crisis

- Steps you need to be taking now to rebuild liquidity and pull out of this dilemma in the future