-

Similarities Between the 2008 Financial Crisis and the Coronavirus Pandemic

Posted By Stephanie Jordan

In our last blog post, we discussed how the Coronavirus was different from our prior economic crisis by beginning as a health crisis, then causing a financial crisis as well. In this blog, I want to discuss a few distinct similarities between the 2008 Financial Crisis and the current Coronavirus Pandemic.

Learning From the 2008 Financial Crisis

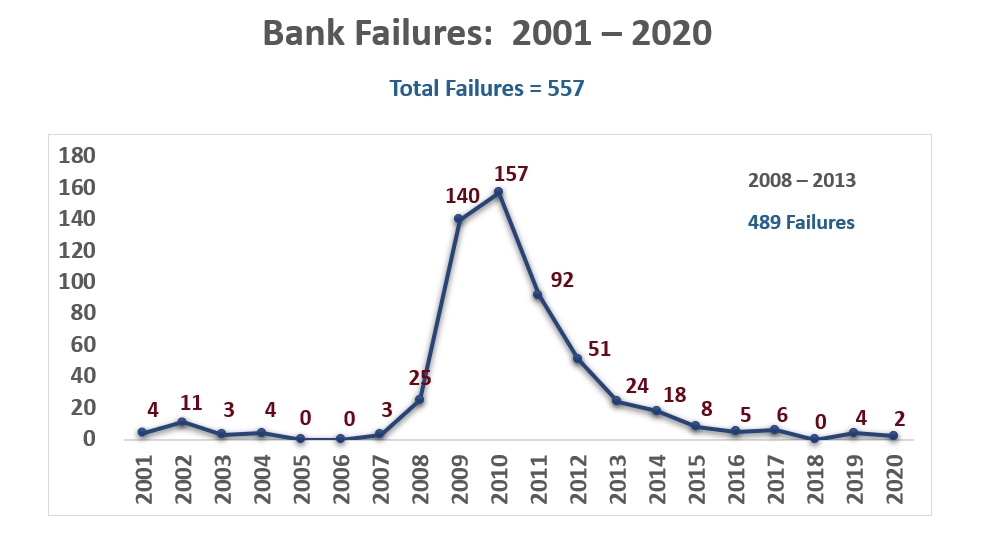

Over the last 20 years, we had 557 bank failures, but 489 of those bank failures, or 88 percent, took place over the five-year period from 2008 to 2013. Nearly all of those failures were community banks with under 10 billion in assets. Based on the graph below we can see that community banks were hit the hardest by the economic impact on the banking system.

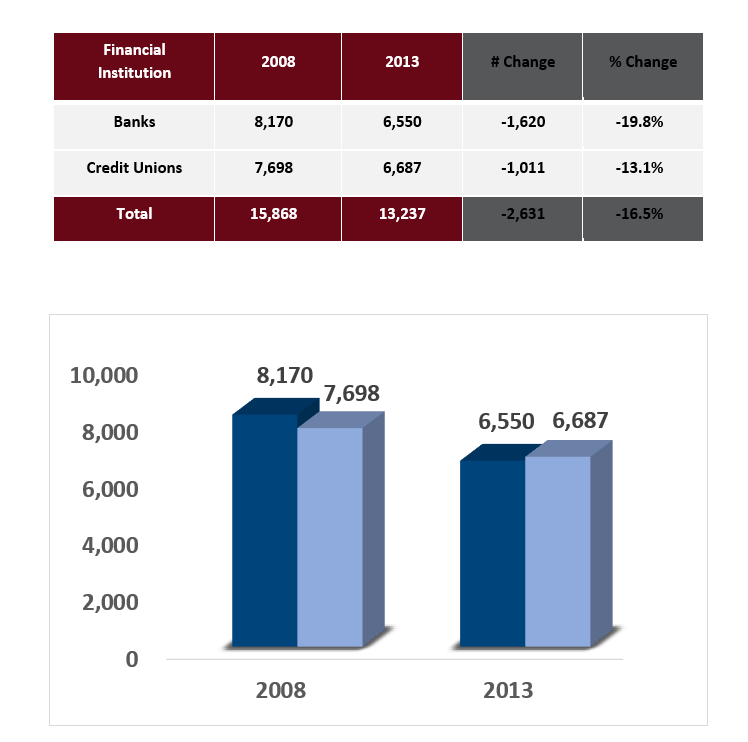

By looking more broadly at the five-year period from 2008 to 2013 for banks and credit unions, you can see the overall consolidation and contraction that took place either due to failures, or mergers and acquisitions below.

By looking more broadly at the five-year period from 2008 to 2013 for banks and credit unions, you can see the overall consolidation and contraction that took place either due to failures, or mergers and acquisitions below.

Sources: FDIC, NCUA and Bloomberg LP

You will notice that we lost more than 1,600 banks, or 19.8 percent, and more than 1,000 credit unions, or 13.1 percent, with an overall decline of 2,600 financial institutions that were lost, or 16.5 percent in aggregate.

Comparing the 2008 Crisis to the 2020 Pandemic

Now that we’ve reflected on the economic impact the 2008 crisis had on financial institutions, let’s review some of the high-level comparisons that we can draw from the 2008 crisis to the 2020 Coronavirus Pandemic.

First and foremost, we have very high unemployment, and a significant loss of not only consumer income and business income, but overall a loss of consumer and business confidence. As a result, financial institutions are getting pressure from regulators to reduce the burden on customers and to increase more loans. In many cases, higher-risk loans include increasing the risk in the loan portfolio.

Also, to combat the crisis and boost the economy the Fed is once again leveraging all its monetary policy tools, including lowering interest rates to zero. As a result, banks and credit unions are experiencing significant losses of interest income, which is also coupled with the losses in fee income due to a significant drop in consumer activity and consumer spending, and also due to the efforts to provide release to customers by either waiving or reducing fees through some of the guidance that was put out by the Fed, the FDIC and the NCUA.

As you can see, there are a lot of similarities between the 2008 and 2020 financial crisis. The good news is that banks and credit unions are well capitalized in general and are in much better shape than they were in 2008. However, that capital will only go so far, and so we believe that the banking community needs to start thinking about planning for profitability on the other side of the Coronavirus Pandemic.

If you would like to learn more about how to balance long-term profitability and capital while still helping your customers and members during this unprecedented time, please check out our latest on-demand webinar, “How to Deal with the Coronavirus Pandemic: A Huge Dilemma for Financial Institutions.” This webinar discusses the following topics:

- Similarities and differences from the 2008 banking crisis, and what we’ve learned from it

- The areas that financial institutions will be squeezed, and proactive measures that need to be taken now

- What we might expect from regulators down the road based on what we learned from the 2008 banking crisis

- Steps you need to be taking now to rebuild liquidity and pull out of this dilemma in the future